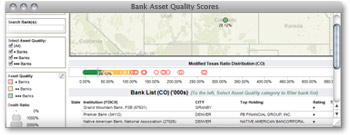

Bank Analysis: Key Performance Indicators (KPIs)

Public Access View Now »

- Ranked banks based on asset quality, loan growth, lending portfolio risk, and high cost funding.

- Draw conclusions on your bank’s overall risk measures.

- Perform ad-hoc visual analysis using a self-service dashboard. Data available in over 7,000 banks.

Premium Access:

- Data available in over 1,000 large bank holding companies and 7,000 banks

- Banking KPIs trends and analytics since 1984

- Detailed Bank Performance Dashboard

- State and National historical analysis

- Trends in Banking KPIs since 1984

Bank Capital Assesment: Stress Test

Public Access View Now »

- Estimate your bank’s additional capital requirements using a state average burn down by loan category.

- Perform a capital assessment stress test analysis using ad-hoc parameters.

- Leverage What-If scenarios in capital requirements for a bank and state.

- Perform ad-hoc visual analysis using a self-service dashboard.

- Ranked banks by additional capital required. Data available in over 7,000 banks.

Premium Access:

- Data available in over 1,000 large bank holding companies and 7,000 banks

- Customize your own weights for loan charge-offs by loan category

- Drill-down to the additional capital required by each asset category

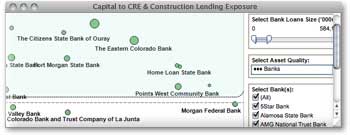

Capital to CRE & Construction Lending Exposure

Public Access View Now »

- Benchmark a bank’s lending portfolio risk and capital level relative to its peers.

- Determine if your bank is positioned to continue lending in these categories given its current portfolio concentrations.

- Discover lending concentration problems relative to asset quality and capital.

- Assess your bank’s compliance with new Basel III capital standards.

- Determine if your bank may be in violation for CRE and Construction lending maximum exposure. Data available in over 7,000 banks

Premium Access:

- Data available in over 1,000 large bank holding companies and 7,000 banks

- CRE and construction lending trends and analytics since 1984

- State and National historical analysis

- Trends in asset quality ratios since 1984

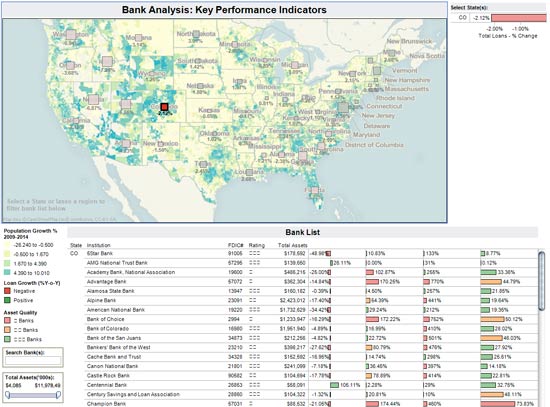

Asset Quality Scores

Public Access View Now »

- Discover banks with relative asset quality problems.

- Understand banking asset quality conditions in your state.

- Benchmark a bank’s asset quality using a self-service dashboard.

- Rank your bank’s asset quality.

- Data available in over 7,000 banks

Premium Access

- Data available in over 1,000 large bank holding companies and 7,000 banks

- Asset quality trends and analytics since 1984

- Disaggregation of asset quality components State and National historical analysis